When potential homebuyers set out to purchase a home, they often begin their journey by seeking pre-approval for a mortgage. Pre-approval signifies that a lender has reviewed your financial information and has determined that you are likely to qualify for a mortgage loan of a certain amount. Yet, it can be frustrating to find out later that, despite being pre-approved, the mortgage gets denied. Understanding why this happens can help you navigate the home-buying process smarter and more efficiently.

The Homebuyer’s Journey

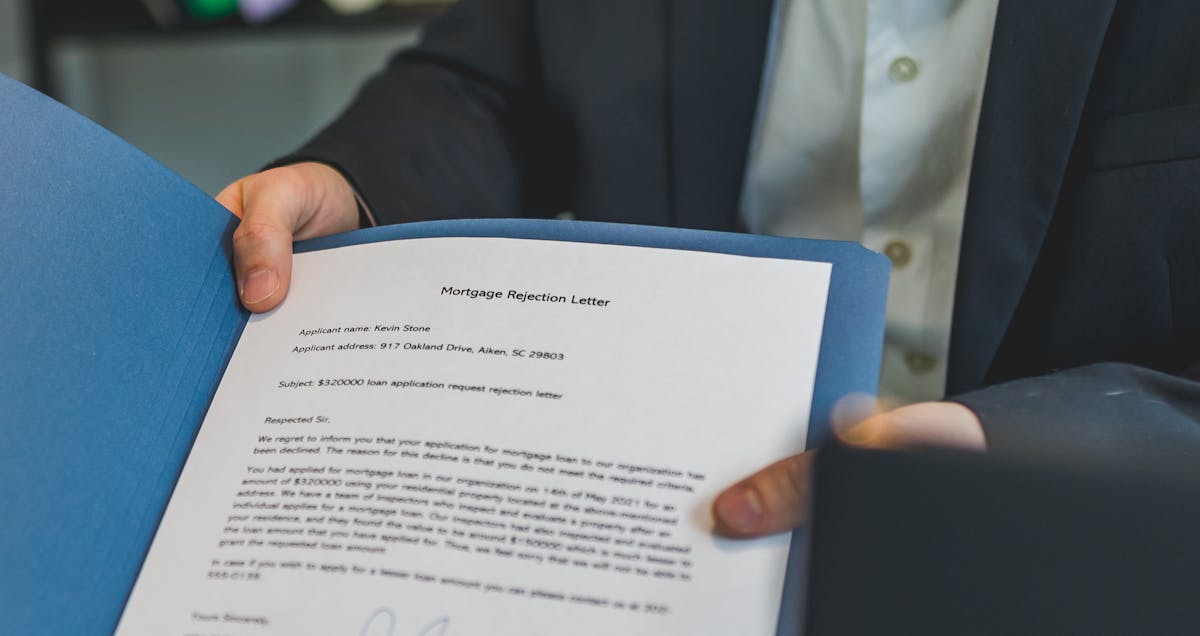

The homebuying journey starts with various financial assessments. Mortgage pre-approval structures the path ahead, but it’s essential to recognize that pre-approval is not a guarantee. During pre-approval, lenders examine your credit score, income, debt-to-income ratio, and overall financial health. However, this initial assessment usually occurs weeks or months before final approval. What are the reasons some buyers receive a firm rejection post-pre-approval?

Common Reasons for Mortgage Denials After Pre-Approval

-

Changes in Financial Status

One of the foremost reasons for denial post-pre-approval is a shift in the buyer’s financial condition. If you’ve changed jobs or suffered a reduction in income, this can negatively affect your mortgage eligibility. Lenders require consistent employment history, and any instability can signal risk. Additionally, if you incur new debts or fail to pay existing ones, your debt-to-income (DTI) ratio could worsen, raising red flags with lenders.

-

Credit Score Fluctuations

It’s crucial to maintain your credit score throughout the home-buying journey. After obtaining pre-approval, many buyers unwittingly impact their credit score by taking on new loans or maxing out credit cards. Furthermore, lenders often check credit scores multiple times during the mortgage process. Any significant dip may sway the lender’s decision. An informed buyer is an empowered buyer; regularly check your credit to avoid surprises (Wikipedia).

-

Inaccurate Information During Pre-Approval

Sometimes applicants misreport their income or debts during the pre-approval process, whether intentionally or unintentionally. If a lender discovers discrepancies between your application and your actual financial records, this can lead to an immediate denial of your mortgage application. Be sure to keep your records accurate and transparent. Efforts to hide debts or inflate income can lead to severe implications later on.

-

Decking Out on New Loans and Debts

It is common for homebuyers to get excited about their new homes and make new purchases, such as a car or furniture, leading up to closing. However, making these financial moves can worry lenders about your ability to manage your finances. Think about the implications of taking on new loans; they can significantly alter your financial standing. A sudden increase in your DTI from extra debt will raise alarms, leading to potential mortgage denial. To learn more about understanding DTI, you can explore how salary deposits affect bank loan approval in the USA.

Documentation Issues

-

Failure to Provide Required Documentation

During the mortgage process, lenders require documentation to back up your pre-approval status. This often includes tax returns, pay stubs, and bank statements. Failure to provide requested documentation can lead to denial. Be proactive in collecting these documents, considering that lenders may come back with inquiries at various stages.

-

Red Flags in Employment History

Lenders typically like to see a stable employment history. If you’ve held many jobs in a short span, this could make lenders skeptical about your long-term job stability. Part-time work or gaps in employment may also negatively sway their opinion. Lenders want to feel confident that you have a steady stream of income to support your mortgage payments.

Property Issues

-

Problems with the Property Itself

Even if your financial situation meets all lender standards, other external factors can lead to mortgage denial. If the property appraisal comes in lower than the agreed purchase price, lenders may deny the mortgage. They use appraisals to ensure that the property value matches the loan amount, and if they perceive a lack of value, they will hesitate to take on that risk. You can read more about hidden fees and complexities in this process in hidden bank fees Americans don’t notice until charged.

-

Issues with Homeowners Association (HOA)

If the property is part of an HOA, lenders will often look closely at HOA rules. Disputes or financial mismanagement within the HOA can influence the final decision. The lender must ensure that the property is maintained and that any prospective issues are worked out. If they perceive that the HOA may not handle these properly, your mortgage could be threatened.

Changes in Regulations and Policies

-

Changing Lending Standards

The mortgage industry is susceptible to market fluctuations, and lending standards may tighten due to changes in government policy or economic conditions. Even if you are in good standing when you apply, shifts in guidelines could affect your eligibility and lead to post-pre-approval denials. Understanding why US banks reject loans despite good income can help clarify this phenomenon.

-

Market Conditions

Economic conditions—including interest rates—play a crucial role in mortgage approvals. If rates rise suddenly, lenders may re-evaluate your application more stringently. You might have had a higher pre-approval amount previously, but lender caution in a volatile market could change that.

Dealing with Denials

Navigating a denial after pre-approval is undoubtedly a challenge. However, it’s not the end of the road. First, ask the lender for precise reasons behind the denial. This information will help diagnose your financial standing and identify areas that might need improvement.

Steps Forward

- Enhance Your Credit Score: Work on building or restoring your credit by paying down existing debts and making timely payments.

- Review Financial Statements: Take a comprehensive look at your income and expenses and make necessary adjustments to lower your DTI.

- Provide Strong Documentation: Have all documentation on hand and be responsive to lender requests.

- Consult Financial Advisors: If you find yourself struggling, a financial expert can provide valuable insights to improve your status.

It’s possible that the lender will tell you that a waiting period is best, giving you time to establish more stable employment or improve your financial health.

Conclusion

Securing a mortgage is a complex process filled with twists and turns. Understanding the potential pitfalls post-pre-approval can save you valuable time and resources. Homebuying is a monumental venture, so be thorough in your preparations. By knowing what factors can lead to a denial, you are better equipped to present yourself as a strong candidate when it’s time for that final approval.

Navigating this journey might not be simple, but with diligence and attention to detail, you can successfully secure the mortgage you need. The nature of lending is evolving, and a proactive approach will help you stay ahead.

Read Also

Leave a Reply